Jakarta, VIVA – Indonesian Ministry of Finance has assured the public that the country’s financial markets have not shown signs of distress following the recent U.S. military strike on Iran.

According to the Ministry’s assessment, the impact on Indonesian financial markets remains within a manageable range and does not indicate a crisis-level situation.

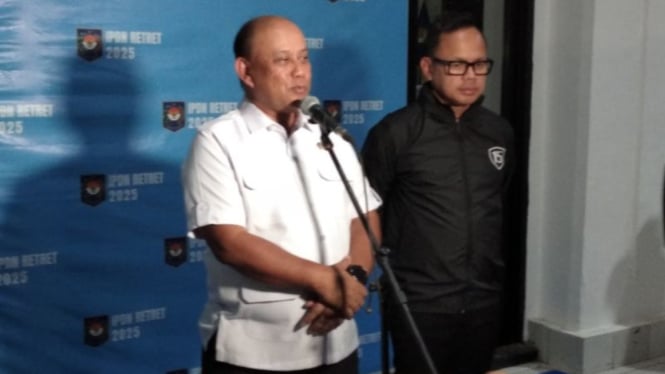

“The level of pressure in Indonesia’s financial markets, based on our current assessment, has not reached a critical stage. The recent softening in risk appetite is still aligned with normal market mechanisms,” said Deni Surjantoro, Head of the Ministry’s Communications and Information Services Bureau on Monday (June 23).

He added that the government, in coordination with other institutions such as Bank Indonesia and the Financial Services Authority (OJK), continues to monitor global developments that may pose risks to the economy and financial sector.

Surjantoro emphasized that any impact is expected to be temporary, as the market continues to observe the evolving geopolitical situation.

Gedung Kementerian Keuangan Republik Indonesia.

For now, financial pressures remain within safe thresholds.

“In the past week, the market pressure has stayed within a safe range and hasn’t caused any significant impact on the economy or the performance of the domestic financial services industry — including fiscal indicators,” he explained.

While global oil prices have surged in response to the conflict, the Ministry believes Indonesia can absorb the inflationary impact, particularly on fuel prices, through existing subsidy and compensation programs.

“The inflationary pressure from rising oil prices is still being managed through government subsidies and compensation. There is still fiscal space available to mitigate domestic inflation risks,” Surjantoro stated.

He pointed out that the current oil price levels remain below Indonesia’s 2025 state budget assumption of US$82 per barrel.

“As of last weekend, Brent crude was priced at US$77.27 per barrel, with the average year-to-date Indonesia Crude Price (ICP) still below US$73. This gives us room to cushion potential inflationary spillovers,” he added.

Despite the current stability, Surjantoro then stressed that the government remains alert to ongoing global risks and their potential transmission to the domestic economy.

The Finance Ministry is preparing early mitigation measures and optimizing the role of the state budget (APBN) as a shock absorber to maintain macroeconomic stability.

“A strong policy synergy between the central and regional governments is essential in anticipating inflation risks. We are also coordinating with fiscal, monetary, and financial authorities. Structural transformation efforts, such as deregulation to ensure fertilizer supply, will continue across various commodities,” he concluded.

Halaman Selanjutnya

While global oil prices have surged in response to the conflict, the Ministry believes Indonesia can absorb the inflationary impact, particularly on fuel prices, through existing subsidy and compensation programs.

8 hours ago

3

8 hours ago

3